The Steel Tariffs imposed by the Trump administration have garnered significant interest; especially in our industry, where both steel and aluminum play a primary role.

This is hardly the first time a sitting President has imposed a tariff on steel. As early as 1979, then Treasury Secretary Alexander Hamilton proposed a series of tariffs, including one on steel, each of the new tariffs was accepted.

More recently, George W. Bush, George H.W. Bush, Ronald Reagan, Jimmy Carter, Richard Nixon, and Lyndon B. Johnson all attempted to protect American steel producers by imposing tariffs on steel imports.

Often, it is tough to distinguish fact from fiction as we wade through the political commentary to understand how legislative decisions, such as this one, influence our industry.

Let’s start with a few basic facts:

- Although dubbed the “Steel Tariffs” the trade sanctions signed into law on March 8, 2018, apply to the import of both steel and aluminum

- The law calls for a 25% import tax on steel and a maximum import tax of 10% on aluminum

- The tariffs do not apply to everyone and are mainly focused on preventing China from dumping excess steel into the U.S. economy

- The United States produced 81.6 million metric tons of steel in 2017 and imported 36 million metric tons

- The United States produced 785,000 metric tons of liquid aluminum in 2017 and imported 5,046,000 metric tons

Why Are We Worried About Excess Steel?

Steel production in China has steadily increased over the last five years.

In a statement issued earlier this year, Chinese officials revealed that they would be unable to absorb the increased steel and aluminum production internally and, as a result, would export it to the rest of the world.

Since the consumption of steel and aluminum is relatively stable, this increase will affect the market. In other words, the supply of steel will outpace the demand causing prices to drop.

The steel industry is worth about $900 billion a year and is seen as a gauge of the world’s economic health. – Fortune

Why is this a bad thing?

The United States steel industry dates back to the Colonial period and is significantly influenced by one of the most powerful unions in the nation, the United Steelworkers Union. As a long-standing part of the American economy, any threat against the US steel industry’s stability is quickly recognized and mitigated.

When supply surpasses demand, there are three economic responses:

- 1. Suppliers shift production to another good.

- 2. Suppliers liquidate their business.

- 3. Suppliers cut costs, seek partnerships, and maneuver through the storm in an attempt to weather the price war while maintaining their market share.

The steel tariffs are meant to prevent China from driving down the cost of steel in the United States and promote healthy growth of US steel production.

If the tariffs are meant to discourage the steel imports and encourage domestic purchasing, then China must be the largest importer of steel in the United States, right?

Indiana is the nation’s leading steel producer, producing 27% of all American-made steel. – American Iron and Steel Institute

Where Does the United States Get Its Steel?

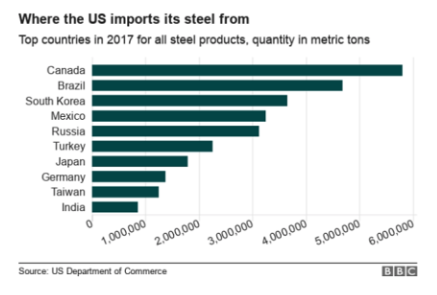

The largest importers of steel to the United States are Canada and Brazil, two countries that are currently being held exempt from the tariffs. Both Canada and Mexico are permanently exempt from the tariffs while Brazil, the EU, and South Korea are part of a group that is enjoying temporary exemption.

This leaves the impact of the tariffs to be most significant in Japan, Russia, and Turkey. However, as a very limited supplier of steel to the United States, the impacts of the tariff in China are not keenly felt.

What Does All of This Mean to the Cost of ACE Blades?

Since most steel imported into the United States comes from countries that are not impacted by the tariffs, the price of steel in the United States should remain relatively stable.

However, this is unlikely to be the case.

Instead, we are likely to see sharp increases in the price of steel and aluminum from all foreign suppliers. As a result, US companies will attempt to source domestically, which will drive the price of US-produced steel up. These price increases will drive up the costs of producing all steel and aluminum products, including our blades and knives.

The good news?

Long-term sustainment of the tariffs is highly unlikely. Not only do tariffs like this alienate key political and trade partners, but they also do little to provide sustainable protection of the US steel industry.

American Cutting Edge has always relied only on responsibly-sourced materials of the highest quality. That is how we do business, and it is how we will continue to do business.

We know that our customers have come to rely on us for our expertise and our experience, in both the design of superior industrial blades and in the logistics and manufacturing processes that make those blades available at the lowest possible price.

We value that trust and stand ready to leverage our experience to ensure that the new steel and aluminum tariffs have minimal impact on ACE customers.